James Montier describes the anatomy of a bubble in his book “Behavioral Investing” John Wiley and Sons, 2007. Ch 38.

Montier outlines the 5 stages of a financial bubble as described in the book “Manias Panics and Crashes”.

There are some interesting parallels between the current markets and past bubbles. The current situation may or not be a bubble bursting, only history will tell however it appears there is a strong case to be made.

5 Stages of a Bubble

-

- Displacement

-

- Credit Creation

-

- Euphoria

-

- Critical stage/Financial distress

-

- Revulsion

Displacement:

Displacement is a shock to the system that creates profit potential in some sectors and simultaneously diminishes profit potential in other sectors.

If the profit opportunities are great enough investors will commit capital to take advantage of this potential.

Investments will be in financial as well as physical assets.

This creates a boom.

The pandemic created just such a scenario.

Some sectors were shut down while others began to thrive. Those that were thriving were able to raise huge amounts of capital.

Credit Creation:

The boom is then fueled by monetary expansion. In this case backstops, quantitative easing and near zero rates from the Fed in addition to huge fiscal stimulus led to a stock market and real estate boom. This also laid the groundwork for inflation.

Euphoria:

Euphoria happens when a boom and very accommodative monetary policy leads to inordinate amounts of speculation in financial markets. Some refer to this as “fear of missing out”. This showed up in speculation in stock options, unprofitable technology companies, NFT’s and “meme” stocks among others.

Critical Stage/ Financial Distress

The critical stage is where insiders and savvy speculators begin to unload stock as they begin to realize current valuations and financial conditions will not persist endlessly.

The financial distress stage occurs when there is a large bank failure or a fraud or some other unexpected event that creates a crisis. (SIVB) (FTX)

Policy error by FED?

Elon Musk asked Twitter followers if he should sell Tesla shares. They said yes. Tesla CEO Elon Musk surprised his Twitter followers by asking them to vote on whether he should sell 10% of his company’s stock. The majority said yes.Nov 8, 2021

Revulsion:

The final stage of the bursting bubble. This occurs when sentiment is so bad that most won’t even consider putting money to work. Generally this happens some period of time after the big decline. Revulsion follows capitulation.

The move ends after either: prices are so depressed value players move in, limits are placed on short selling and declines, or a buyer of last resort steps in (FED).

Where are we now?

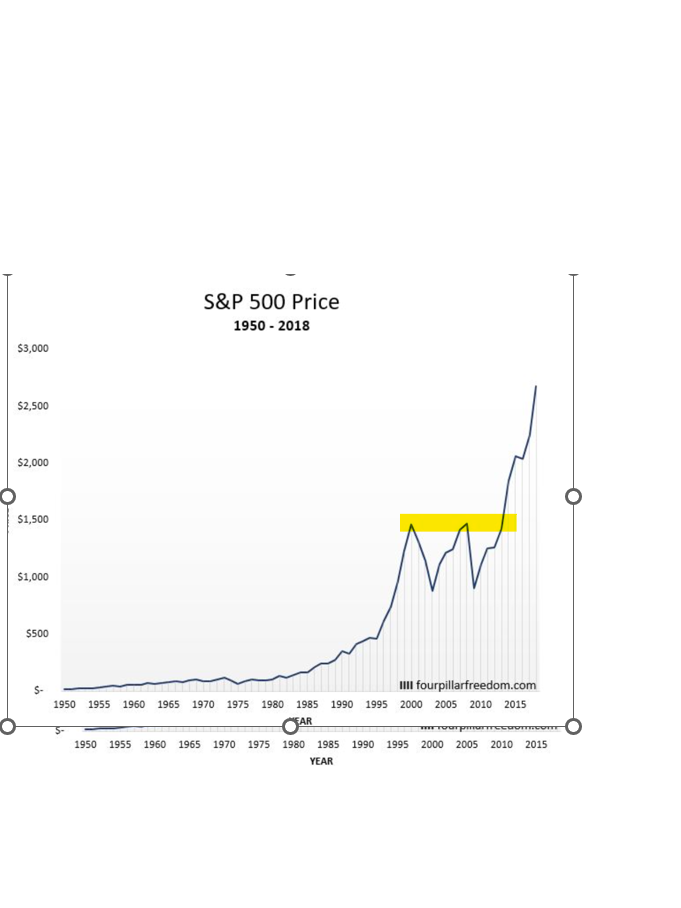

It is possible we are in the early stages of the Critical Stage/Financial distress part of the cycle. We have seen parts of the market shows signs of a burst. There have been a few unexpected bank failures and a couple crypto frauds. The ARK Innovation ETF which has owned a large percentage of unprofitable technology stocks has come crashing down as have some other sectors. The question as to how widespread the damage will be remains to be seen. After the tech crash in 2000 it took 8 long years for the S&P 500 to recover. After the 2008 bear market it took 6 years to recover the highs. Managing risk, as always will be very important.